Introduction

To my way of thinking, if anyone is really serious about conducting business in an ethical way, then there are certain basic rules. Here’s my list (in no particular order):

- Delivering value to customers

- Investing in employees

- Dealing fairly and ethically with suppliers

- Supporting the communities in which they operate

- Generating long-term value for shareholders, who provide the capital that allows companies to invest, grow and innovate

- Enhancing and not detrimentally affecting, the environment in which they operate.

Nevertheless, the relentless pursuit of profit regardless of the impact is still prevalent in far too many companies. With access to prodigious resources for legal action, some big businesses will do anything to protect their profits and share value, (or reputation and ego) even to the detriment of their own employees, contractors, customers or indigenous populations.

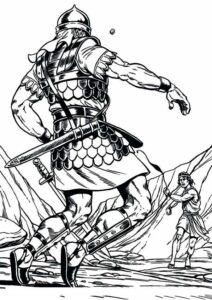

With this in mind, and because I love stories of underdogs winning out against the fiercest odds, I’ve gathered a few stories of relatively recent incidents where a David or two have gone head-to-head with some Goliaths and, in most cases, prevailed.

UK Post Office

Between 2000 and 2014, more than 700 sub-postmasters were wrongly accused of theft or false accounting by the UK Post Office. Many were fined, some even went to jail and more than a few were ruined financially and left with their reputation in tatters, in what has been described as the most widespread miscarriage of justice in UK history. After more than a decade, investigative journalist Nick Wallis eventually got to the bottom of the scandal and discovered that there were bugs (errors) in Horizon, the software package developed by Fujitsu. It was rolled out by the UK Post Office to all post offices in the UK, even though upper management knew that there were still issues with the software.

A class action by over 500 sub-post masters against the Post Office was won in the UK Appeal Court on 18th November 2021.

Boeing Aircraft Corporation

Boeing was under intense pressure. American Airlines, which had been an exclusive Boeing customer for many years, was planning to place an order with Boeing’s biggest rival, Airbus, for hundreds of new fuel-efficient jets. There was no time to design a new ‘plane, so a plan was hatched to update its 737 workhorse, and the 737 Max was born. It was essentially the same as earlier models, which meant that it could get certified quickly. Crucially, it also meant that pilot training could be kept to a minimum, cutting down costs. But tragically, less than 4 years from launch, 346 people were killed in two separate crashes, one in Indonesia and one in Ethiopia, as a direct result of these decisions. Boeing initially blamed the pilots, but eventually had to admit that an embedded flight correction software package had not been disclosed to the pilots.

“Boeing’s employees chose the path of profit over candor by concealing material information from the FAA concerning the operation of its 737 Max airplane and engaging in an effort to cover up their deception”

The US government reached a $2.5 billion settlement with Boeing in 2021, absolving the airplane manufacturer from facing criminal charges. The families of the victims received some financial compensation, but allege that the government violated their legal rights with this agreement and have requested that a federal judge rescind the deal. The saga is, as yet, unresolved.

In unrelated cases, especially in the South Carolina 787 Dreamliner assembly plant, managers were financially rewarded to increase production, which had a very detrimental knock-on effect on quality. Quality managers were sidelined and issues such as faulty lithium batteries and waste items left on aircraft after production, arose.

In addition to this, Boeing lost a NASA contract to Space-X, an Elon Musk start-up, to service the International Space Station. The question is, how long can Boeing keep going? It was being propped up under the Donald Trump administration, but will a Biden government do the same? Only time will tell.

Chevron Oil Company

Probably the largest oil-related environmental catastrophe in the world exists quietly in the Amazon rainforest, threatening to wipe out five indigenous groups, largely out of sight of the world’s media. Texaco, a subsidiary of Chevron, is infamous for dumping 16 billion gallons of oil into ancestral land in the Amazon. Chevron was taken to court for pollution by the indigenous people of the area in Ecuador and won an $18 billion settlement. But in 2018, the Permanent Court of Arbitration in The Hague unanimously issued an award in favour of Chevron and determined that the judgement in Ecuador was “fraudulent, and corrupt”. Chevron is still making healthy profits and have yet to declare compliance with the Paris Agreement on global warming. How much longer can they keep this up before the wrath of public opinion weighs them down?

Meanwhile the oil spills continue in the Amazon and groups such as the Amazonian Indigenous Peoples United in Defense of their Territories (PUINAMUDT) continue the fight.

Borneo Forest logging

Borneo has lost 50% of its rainforest in the past 50 years. Borneo Island is split between Indonesia and Malaysia, the Malaysian part consisting of two provinces, Sabah and Sarawak. The Governor of Sarawak, Taib Mahmud, has been a key player in the award of all logging contracts for more than 20 years, where it is believed that he has taken bribes and is now one of the richest men in the world. He has also been instrumental in the erection of two large dams, thereby destroying large tracts of rainforest habitat and displacing indigenous tribes. (It probably comes as no surprise to learn that the dams supply power to a large aluminium smelter which is owned by his family.)

Two of the few advocates for the indigenous people of Sarawak, Clare Rewcastle and the Sarawak Report, and The Bruno Manser Foundation, have had limited success in protecting the orang asli (people of the forest), but the fight goes on.

Pacific Gas and Electric Company (PG&EC) ground water contamination

From 1952 to 1966, Pacific Gas and Electric Company (PG&EC) dumped about 370 million gallons of chromium tainted waste-water into unlined waste-water spreading ponds around the town of Hinkley, north of Los Angeles.

In 1993, legal clerk Erin Brockovich began an investigation into the health impacts of the contamination. A class-action lawsuit was settled in 1996 for $333 million, the largest settlement of a direct action lawsuit in U.S. history. Hinkley is now a ghost town.

Amazon Corporation

The Amazon Labour Union (ALU) is led by Christian Smalls, a former Amazon manager. He was fired by Amazon amidst the Covid epidemic as the cases in the their Staten Island warehouse (JFK8) were escalating. Workers felt that the company was not addressing the threat and a walkout was staged demanding the work site’s closure.

Christian motivated Amazon employees to vote in favour of unionization and did something miraculous: They licked a well-resourced anti-union campaign run by the nation’s second-largest employer, a corporation with virtually unlimited financial and legal resources, yet without any help from a major union. This is a truly great David and Goliath story.

Cape Asbestos

In 1997, a group of five South Africans suffering from asbestos-related disease (ARD) brought suit against Cape PLC in the English High Court seeking compensation for their injuries from Cape’s asbestos mining activity in South Africa. In 1999, another 2000 claims were commenced against Cape in England for ARD also based on Cape’s activity in South Africa. By 2001 there were approximately 7500 claimants.

In 2001, Cape agreed to a £21 million out-of-court settlement with the plaintiffs, but the company encountered financial problems in August 2002 and did not meet the agreed settlement terms. The litigation recommenced in September 2002, and Gencor Ltd. was joined as a defendant in the case. (Gencor is a South African company which took over some of Cape’s South African asbestos operations when Cape left the country in 1979.)

A settlement was finally reached in 2003 between the plaintiffs, Cape and Gencor.

Shell Oil

‘Oil spills are a common event in Nigeria. Half of all spills occur due to pipeline and tanker accidents. Other causes include sabotage (28%) and oil production operations (21%), with 1% of the spills being accounted for by inadequate or non-functional production equipment. A UNDP report states that there have been a total of 6 817 oil spills between 1976 and 2001, which account for a loss of three million barrels of oil, of which more than 70% has not been recovered. 69% of these spills occurred off-shore, 25% were in swamps and 6% on land.’

Ken Saro-Wiwa attempted to stop the destruction of the Niger Delta environment and was hanged by the then dictator of Nigeria. Shell executives were accused of collaboration over the murder of Saro Wiwa and subsequently paid $15.5 million to one group of activists’ families, including the Saro-Wiwa estate. Shell denied any responsibility or wrongdoing.

In December 2018, Shell shareholders agreed with Shell directors to focus on the requirements of the Paris Accord on global warming.

In 2019, Shell was taken to court to legally compel them to cease its destruction of the climate, on behalf of more than 30,000 people from 70 countries. On 28th May 2021 the judge ruled that Shell must reduce its CO2 emissions by 45% by the year 2030.

With respect to ‘greenwashing’, stand-up comedian Joe Lycett in ’Joe Lycett vs The Oil Giant’ gets right to the bone with his brilliant scathing sendup of Shell. (https://www.dailymotion.com/video/x852yaz )

In spite of it all, Shell remains one of the top earning companies in the world. Hopefully the influence of a great many Davids is pushing Shell in the direction of being truly sustainable.

ExxonMobil

In the case of a fraudulent statement to shareholders about the financial risks of climate change, the US Attorney General took ExxonMobil to court in October 2019. This was the first notable climate change lawsuit against a major oil company. ExxonMobil was allegedly using two distinct sets of metrics to calculate the financial risks of climate change, one that was shared with investors and another that was used internally. The ExxonMobil lawsuit serves to highlight that the risk of climate related lawsuits is both real and potentially very costly. Regrettably, the Judge ruled against the Attorney General.

Persuading ExxonMobil to become sustainable is a difficult task. However, the investment company Engine No. 1 has begun the fight by successfully nominating three board members with proven sustainability track records onto the ExxonMobil board. The Davids are now working from inside the company and will hopefully get the ball rolling.

Volkswagen (VW)

Volkswagen’s unethical activities relating to emission testing of their diesel car engines was a major set back for the company. VW’s advertising campaign in the US promoted the Golf diesel claiming excellent fuel economy, but the real picture was totally different.

The Volkswagen emissions scandal, sometimes known as Dieselgate or Emissionsgate, began in September 2015, when the United States Environmental Protection Agency (EPA) issued a notice of violation of the Clean Air Act to VW. The agency had found that VW had intentionally programmed diesel engines to activate their emissions controls only during laboratory emissions testing to meet US NO x standards, while they emitted up to 40 times more NO x in real-world driving. VW deployed this software in about 11 million cars worldwide, including 500,000 in the United States.

Regulators in multiple countries began to investigate VW, and its stock price fell massively by a third in the days immediately after the news.

The CEO resigned and at least 6 executives were charged in the USA.

In April 2016 Volkswagen announced plans to spend $18.32 billion on rectifying the emissions issues, and planned to refit the affected vehicles as part of a recall campaign. In January 2017, Volkswagen pleaded guilty to criminal charges and signed an agreed Statement of Facts.

Saving Aru

Cases of indigenous people fighting against big companies and their political allies wanting to invade their lands, and winning, are few.

In the mid-1800s, the extraordinary biodiversity of the Aru Islands helped inspire the theory of evolution by natural selection.

On 2010, however, a corrupt politician, Theddy Tengko, who had governed the Indonesian islands of Aru for nearly a decade, granted a single company, Menara Group, permission to convert most of the islands’ rainforests into a vast sugar plantations.

The people of Aru fought back. And won. Today, the story of their grassroots campaign resonates across the world as a growing global movement seeks to force governments to act on climate change.

Minamata

‘From 1932 to 1968, Chisso Corporation dumped an estimated 27 tons of mercury compounds into Minamata Bay.’

For years, residents of Minamata, a town located on Kyushu (Japan’s most southwesterly island), had observed odd behavior among animals. People referred to the behavior as “cat dancing disease”. In 1956, the first human patient was identified. Symptoms included convulsions, slurred speech, loss of motor functions and uncontrollable limb movements. Three years later, an investigation concluded that the affliction was a result of industrial poisoning of Minamata Bay by the Chisso Corporation where large amounts of mercury and other heavy metals found their way into the fish and shellfish that comprised a large part of the local diet. Thousands of residents have slowly suffered over the decades and died from the disease.

A group of Minamata victims filed a lawsuit in 1969 against Chisso alleging corporate negligence. Eventually, after Life magazine published photos of those affected by Minamata disease, public opinion turned against the company and a court ruled in 1973 that Chisso should pay compensation to the victims.

As of March 2001, over 10,000 individuals had received financial remuneration from Chisso in recompense for the harm caused by the chemical release.

The case still goes on though. A group of seven Minamata patients had their demand to be legally recognized as suffering from the condition rejected by a court in March 2022.

Conclusion

It stands to reason that satisfying shareholders is of prime importance to the directors of a company. It is also in the interests of the shareholders, especially institutional investors who are interested in long term returns, to assess these long term risks and, in turn, to influence the directors’ behaviour accordingly. This translates into consideration for staff, suppliers, customers and the community & environment in which the company operates. Ethical management is crucial to the long term success of a business.

I’m hopeful that, in future, companies will be influenced to behave more ethically and there won’t be a need for David and Goliath battles.ing field.